-

Posted on: 07 Jan 2026

-

Navigating the world of satellite TV can be daunting, especially when credit concerns arise. If you're wondering, "Can you get DIRECTV with bad credit?", the answer is often yes, but with specific considerations. This guide explores your options, alternative solutions, and how to improve your chances of approval for DIRECTV services, even with a less-than-perfect credit history.

Understanding Credit Checks for Satellite TV

When you sign up for a new service that involves monthly payments, such as satellite television, internet, or mobile phone plans, providers often perform a credit check. This is a standard practice designed to assess the risk associated with extending credit to a new customer. For satellite TV providers like DIRECTV, this check helps them determine whether to require a security deposit, what payment plan might be appropriate, and ultimately, if they can approve your service application.

The credit check typically involves reviewing your credit report from one or more of the major credit bureaus (Equifax, Experian, TransUnion). This report contains information about your credit history, including:

- Payment history (on-time payments, late payments, defaults)

- Amounts owed

- Length of credit history

- Credit mix (types of credit accounts)

- New credit applications

Based on the information in your credit report, a credit score is generated. This score is a three-digit number that summarizes your creditworthiness. While specific score ranges vary, generally:

- Excellent Credit: 750+

- Good Credit: 670-749

- Fair Credit: 580-669

- Poor Credit: Below 580

For services that require a contract or involve significant equipment costs, providers often look for scores in the good to excellent range. However, for services like satellite TV, the thresholds can be more flexible, especially with the availability of alternative solutions or deposit options. It's important to understand that a "bad credit" score doesn't automatically disqualify you from all services, but it might lead to certain conditions being applied.

The purpose of the credit check is not just to protect the provider but also to ensure a sustainable service for the customer. By assessing risk, providers can tailor their offerings and payment structures to match a customer's financial profile, reducing the likelihood of service interruption due to non-payment.

How Credit Scores Impact Service Approval

Your credit score plays a significant role in whether your application for satellite TV service is approved and under what terms. Providers use it as a primary indicator of your reliability in meeting financial obligations. A higher credit score suggests a lower risk to the provider, often leading to:

- Automatic approval without a deposit.

- Access to the widest range of promotional offers and packages.

- More favorable contract terms.

Conversely, a lower credit score signals a higher risk. In such cases, providers might:

- Require a security deposit to mitigate potential losses.

- Limit the available package options.

- Offer a month-to-month service plan instead of a long-term contract.

- In some instances, outright deny service if the credit risk is deemed too high.

It's crucial to remember that credit checks for services like satellite TV are often "soft inquiries," which do not negatively impact your credit score. However, multiple "hard inquiries" from applying for new credit cards or loans can lower your score.

The Role of Credit Reports

Beyond the score, the details within your credit report are also scrutinized. A provider might look at specific aspects of your history, such as:

- Recent delinquencies: A history of late payments or collections can be a red flag.

- Length of credit history: A longer, well-managed credit history is generally viewed favorably.

- Public records: Bankruptcies or judgments will significantly impact approval chances.

Understanding these elements can help you prepare for the application process and address any potential concerns before you apply.

DIRECTV's Stance on Credit Requirements

DIRECTV, like most major pay-TV providers, does conduct credit checks for new customers. The specific requirements can vary depending on the package you choose, current promotions, and the prevailing economic conditions. However, the overarching goal is to assess your ability to pay for the service consistently over the contract term.

In 2025-26, DIRECTV's credit policies continue to evolve, but generally, they aim to be accessible to a broad range of consumers. The company understands that not everyone has a perfect credit score, and they have mechanisms in place to accommodate this.

Credit Score Thresholds for DIRECTV

While DIRECTV doesn't publicly disclose exact credit score cutoffs, industry experience suggests the following:

- Good to Excellent Credit (typically 670+): Most likely to be approved without a deposit and eligible for all promotional offers.

- Fair Credit (typically 580-669): Approval is still likely, but a security deposit might be required. The deposit amount can range from $100 to $300 or more, depending on the services and equipment selected. You may also have access to most, but perhaps not all, of the top-tier promotions.

- Poor Credit (below 580): Approval becomes more challenging. A significant security deposit is highly probable, or you might be limited to specific, lower-tier packages. In some cases, if the credit risk is deemed too high, service may be denied.

It's important to note that these are general guidelines. DIRECTV's internal scoring models might consider other factors beyond just the FICO score, such as your payment history with other utility or telecom providers, and the length of time since any negative marks appeared on your report.

The Role of Security Deposits

For customers with less-than-perfect credit, a security deposit is a common requirement from DIRECTV. This deposit acts as a financial safeguard for the provider, covering potential unpaid bills or unreturned equipment. The amount of the deposit is typically determined by the credit assessment and the total value of the services and equipment being provided.

Typical Deposit Ranges (2025-26 Estimates):

- Fair Credit: $100 - $200

- Poor Credit: $200 - $300+

The good news is that security deposits are often refundable. DIRECTV may refund your deposit after a certain period of consistent, on-time payments (e.g., 6-12 months) or when you eventually upgrade your service or disconnect your account in good standing.

What If DIRECTV Denies Your Application?

If DIRECTV denies your application based on a credit check, they are required by law (under the Fair Credit Reporting Act) to inform you of the denial and provide the name and contact information of the credit reporting agency used. This allows you to obtain a free copy of your credit report and dispute any inaccuracies.

Denial doesn't mean you can't get satellite TV. It simply means DIRECTV's current credit criteria weren't met. This is where exploring alternative providers or strategies to improve your chances becomes essential.

Alternatives to DIRECTV for Those with Bad Credit

If your credit history presents a barrier to getting DIRECTV, or if you prefer not to go through a credit check, several alternative solutions exist. These options are often designed to be more accessible to individuals with lower credit scores or those who prefer prepaid or no-contract services.

Prepaid Satellite TV Options

While DIRECTV itself doesn't offer a traditional prepaid service, some smaller providers or third-party resellers might. These services allow you to pay for your TV service in advance, typically on a monthly or weekly basis. This eliminates the need for credit checks entirely, as you're not incurring any debt.

How they work:

- You purchase a receiver and satellite dish (sometimes leased).

- You pay for a specific amount of service time upfront.

- Once your prepaid time runs out, your service stops until you add more credit.

Considerations:

- Channel selection: Prepaid options might offer a more limited selection of channels compared to standard subscription packages.

- Equipment costs: Initial equipment purchase or lease fees can sometimes be higher than with contract services.

- Availability: These services are not as widespread as major providers.

Other Satellite TV Providers with Flexible Policies

While DIRECTV is a major player, other satellite providers may have different credit policies. For example, DISH Network is often cited as being more flexible with credit requirements, sometimes offering service with lower deposits or even no deposit for customers with fair credit.

Key differences to look for:

- Deposit requirements: Some providers have lower standard deposit amounts or waive deposits for a wider range of credit scores.

- Contract lengths: Providers offering month-to-month plans without strict credit checks can be a good option.

- Third-party retailers: Sometimes, independent retailers selling satellite TV services might have their own approval processes that are less stringent than the direct provider's.

- Live TV Streaming Services:

- YouTube TV: Offers a comprehensive channel lineup, similar to cable/satellite.

- Hulu + Live TV: Combines on-demand content with live channels.

- Sling TV: A more budget-friendly option with customizable channel packages.

- FuboTV: Focuses heavily on sports but includes a wide range of entertainment channels.

- On-Demand Streaming Services:

- Netflix

- Max (formerly HBO Max)

- Disney+

- Amazon Prime Video

- No Credit Checks: Most services only require a valid payment method.

- Flexibility: Easily cancel or switch plans month-to-month.

- Cost-Effectiveness: Often cheaper than traditional satellite or cable, especially if you only subscribe to the channels you watch.

- Accessibility: Requires only an internet connection and a compatible streaming device (smart TV, streaming stick, computer, tablet, phone).

- Internet Dependency: Requires a stable and fast internet connection.

- Buffering/Quality Issues: Can be affected by internet speed and congestion.

- Channel Limitations: Some niche channels might not be available on all streaming platforms.

- One-time equipment purchase.

- No monthly fees.

- Access to major local networks.

- Limited channel selection (only local broadcast).

- Reception can vary based on location and obstructions.

- Requires a TV with a digital tuner (most modern TVs do).

- Incorrect personal information.

- Accounts that don't belong to you.

- Incorrectly reported late payments or defaults.

- Duplicate entries.

- Focus on paying down credit card balances. Aim to keep utilization below 30%, and ideally below 10%.

- Prioritize paying off smaller balances first (the "snowball" method) or high-interest debt (the "avalanche" method).

- Set up automatic payments for all your bills.

- Use calendar reminders for due dates.

- If you've missed payments in the past, focus on maintaining a perfect payment record for at least 6-12 months prior to applying for DIRECTV.

- Trust: Choose someone you trust implicitly and who trusts you.

- Risk to Co-signer: If you default, it will negatively impact their credit score.

- DIRECTV Policy: Confirm if DIRECTV allows co-signers for service applications. Not all companies do.

- ENTERTAINMENT: The most basic package, offering a good selection of popular channels, including news, general entertainment, and some sports.

- CHOICE: Includes all ENTERTAINMENT channels plus more sports, regional sports networks (RSNs), and expanded movie/documentary channels.

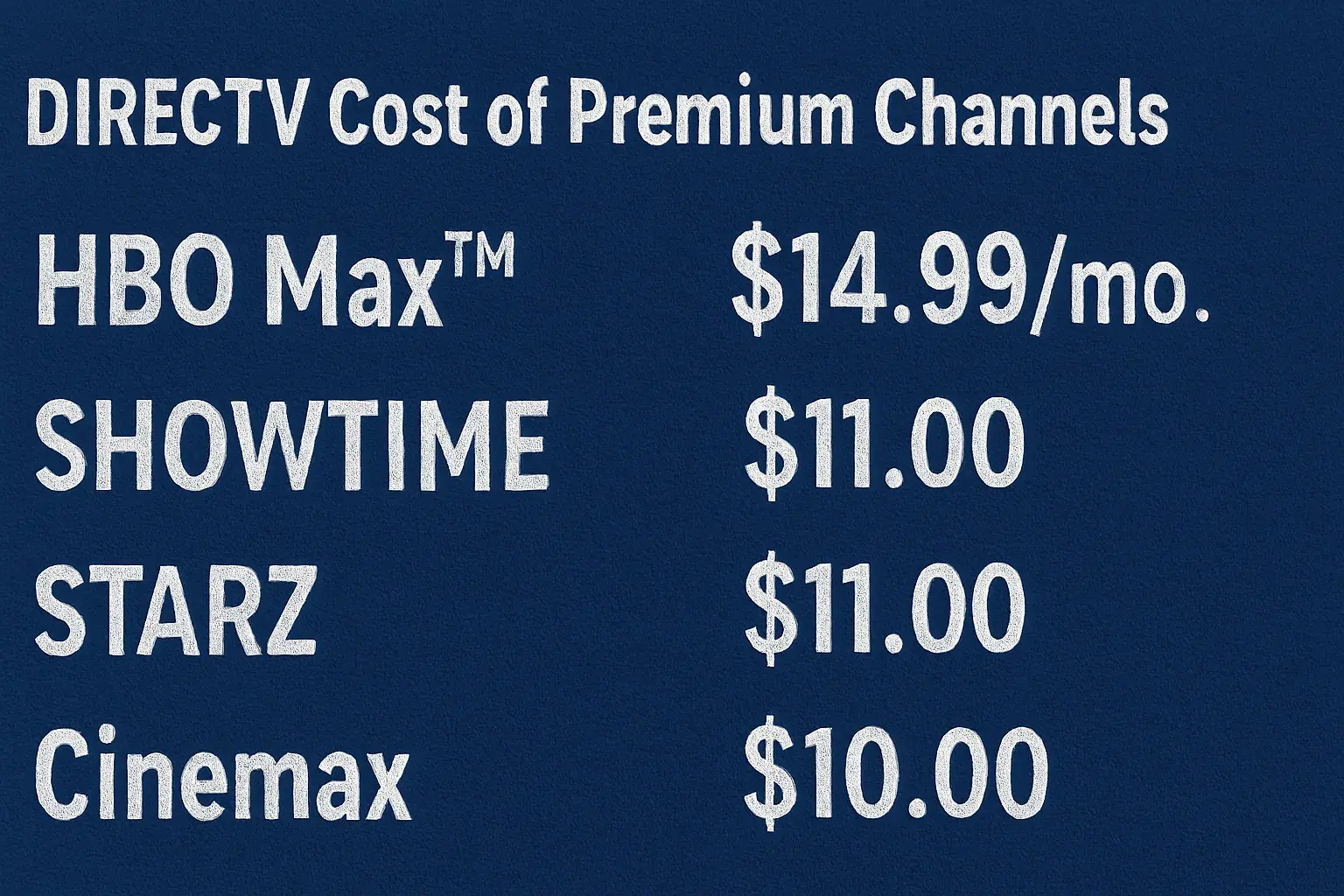

- ULTIMATE: Adds even more premium channels, including more sports, movie channels, and specialized content.

- PREMIER: The top-tier package, featuring all channels, including premium movie channels like HBO, Cinemax, SHOWTIME, and STARZ, plus extensive sports coverage.

- Lease Fees: Standard leases are often covered by promotions, but without good credit, these promotions might be unavailable, leading to higher monthly equipment charges.

- Upfront Payments: A deposit may be required for leased equipment, or you might need to purchase it outright.

- Installation: Professional installation is usually included but may have associated fees if not covered by a promotion.

- Automatic Payments: Set up auto-pay from your bank account or debit card. This is the most reliable way to ensure you never miss a due date.

- Bill Reminders: If auto-pay isn't feasible, use calendar alerts or reminders on your phone a few days before the due date.

- Payment Methods: Understand the payment methods DIRECTV accepts (online portal, phone, mail, app) and choose the most convenient and reliable one for you.

- Package Name and Price: Verify it matches your agreement.

- Promotional Credits: Ensure any discounts you're entitled to are applied correctly.

- Equipment Fees: Check charges for leased or purchased equipment.

- Pay-Per-View or On-Demand Purchases: Be mindful of any accidental or unauthorized purchases.

- Taxes and Fees: Understand the breakdown of local, state, and federal taxes, as well as any regulatory fees.

- Temporary Financial Hardship: Explain your situation. They may offer a payment extension or a temporary payment plan.

- Billing Errors: Report any discrepancies you find on your bill.

- Service Issues: If you experience technical problems, prompt reporting can help resolve them faster.

- Deposit Refund Inquiries: Once you've met the criteria for a deposit refund, reach out to inquire about the process.

- Contract Terms: Be aware of any contract renewal or early termination fees associated with changing your package.

- Credit Re-evaluation: Upgrading might trigger another credit check, though it's usually a soft inquiry.

- Deposit Adjustments: Changing packages could potentially affect your security deposit amount.

- On-Time Payments: Maintaining a perfect payment record for 6, 12, or sometimes 18 months consecutively.

- Service Upgrade: Sometimes, upgrading to a higher-tier package can lead to a deposit refund or adjustment.

- Account Closure: If you close your account in good standing, the deposit (minus any outstanding balances) will be refunded.

- DIRECTV: Generally perceived as having slightly stricter credit requirements, often requiring deposits for fair credit.

- DISH Network: Often considered more flexible, sometimes offering lower deposits or no deposit for customers with fair credit. They may also have more lenient payment plan options.

- Both offer a wide range of packages from basic to premium.

- Pricing structures are competitive, with both relying heavily on introductory promotions that require long-term commitments (typically 24 months).

- Pricing can vary significantly based on the specific channels, sports packages (especially Regional Sports Networks), and equipment included.

- Both use advanced DVR technology (DIRECTV's Genie, DISH's Hopper).

- Lease agreements and installation policies are generally similar, though specific terms can differ.

- Cable providers also conduct credit checks and may require deposits for poor credit. Their policies are generally comparable to satellite providers.

- Cable is only available in areas with existing cable infrastructure. Satellite is available almost anywhere in the US.

- Cable performance is generally not affected by weather, whereas heavy rain or snow can sometimes disrupt satellite signals.

- Similar package structures and pricing models, heavily reliant on bundled offers and long-term contracts.

- This is DIRECTV's own internet-based streaming service. It offers a similar channel lineup to DIRECTV satellite but is delivered over your internet connection.

- Credit: DIRECTV Stream typically requires a credit check, though it might be less stringent than satellite, and often allows for a month-to-month option without a long-term contract. Deposits may still apply.

- Credit: These services generally do NOT require a credit check. They operate on a prepaid, month-to-month model.

- Flexibility: You can sign up and cancel at any time with no penalties.

- Cost: Can be more affordable than satellite/cable, especially if you curate your channel selection.

- Channel Selection: Do they carry the specific channels you watch most (e.g., RSNs for local sports, specific movie channels)?

- Promotional Offers: Compare the length and value of introductory discounts. Read the fine print carefully regarding price increases after the promotional period.

- Contract Length: Are you comfortable with a 12 or 24-month commitment, or do you prefer month-to-month flexibility?

- Equipment Quality: Research the DVR capabilities and user interface of the equipment offered.

- Customer Service Reputation: Look for reviews regarding customer support responsiveness and effectiveness.

- Bundling Options: Can you bundle TV with internet or phone services for potential savings?

- Budgeting assistance.

- Debt management plans.

- Guidance on improving your credit score.

- Education on financial responsibility.

- Companies promising guaranteed credit repair overnight.

- Offers that require upfront fees for services you can obtain for free (like credit reports).

- Anyone asking for your bank account or credit card information over the phone for a "guaranteed" approval.

Researching providers like DISH and comparing their specific credit policies and deposit requirements is a wise step.

Internet-Based TV Streaming Services

This is arguably the most significant alternative for those with credit concerns. Streaming services do not typically require credit checks because they operate on a month-to-month subscription model, often paid for with a debit card or credit card that you already have.

Popular Options (2025-26):

Advantages:

Disadvantages:

For many consumers, especially those with bad credit, streaming services offer a compelling and accessible way to enjoy a wide variety of entertainment without the hurdles of traditional pay-TV providers.

Over-the-Air (OTA) Antennas

For free local broadcast channels (ABC, CBS, NBC, FOX, PBS, etc.), an OTA antenna is an excellent, credit-free solution. With the digital transition, modern antennas can receive crystal-clear HD signals.

Pros:

Cons:

Combining an OTA antenna with a streaming service can provide a comprehensive and affordable entertainment package without any credit concerns.

Strategies to Improve Your Chances of DIRECTV Approval

If you're set on DIRECTV and your credit isn't stellar, don't despair. There are proactive steps you can take to increase your likelihood of approval or at least secure more favorable terms, potentially reducing or eliminating the need for a large security deposit.

Checking and Correcting Your Credit Report

The first and most crucial step is to understand your credit standing. You are entitled to a free copy of your credit report from each of the three major credit bureaus (Equifax, Experian, TransUnion) once every 12 months through AnnualCreditReport.com. Review these reports meticulously for any errors.

Common errors include:

If you find any inaccuracies, dispute them immediately with the credit bureau. Correcting errors can sometimes lead to a significant improvement in your credit score.

Paying Down Existing Debt

High credit utilization (the amount of credit you're using compared to your total available credit) can negatively impact your score. Even if you don't have late payments, carrying high balances on credit cards can signal financial strain.

Actionable steps:

Reducing your overall debt burden demonstrates financial responsibility and can boost your credit score before applying for DIRECTV.

Making On-Time Payments

Payment history is the most significant factor in your credit score. Even if you have past issues, demonstrating a recent pattern of on-time payments is vital.

Tips for consistency:

Considering a Co-signer

If your credit is particularly weak, a co-signer with good credit might be an option. A co-signer agrees to be legally responsible for the debt if you fail to pay. This can significantly improve your chances of approval and potentially waive the need for a deposit.

Important considerations:

Offering a Larger Security Deposit

If DIRECTV offers you service but requires a deposit, and you have the funds available, consider offering a larger deposit than initially requested. This can sometimes persuade the provider to approve your application, especially if your credit score is borderline.

A larger deposit demonstrates a commitment to the service and reduces the provider's risk, making them more comfortable extending service to you.

Timing Your Application

The best time to apply for DIRECTV is when your credit profile is as strong as possible. If you know you have upcoming credit events (like a large debt being paid off) that will improve your score, it might be worth waiting a few months before submitting your application.

Also, be aware of promotional periods. Sometimes, providers offer deals that are more lenient on credit requirements during specific sales events. However, always read the fine print.

DIRECTV Packages and Pricing Considerations

When applying for DIRECTV with less-than-perfect credit, understanding the available packages and their associated costs is crucial. The type of package you choose can influence the credit requirements and the potential need for a security deposit.

Understanding DIRECTV Package Tiers

DIRECTV offers a range of packages, typically categorized by the number and type of channels included. These generally range from basic entertainment bundles to premium sports and movie packages.

General Tiers (2025-26):

The higher the tier, the more expensive the package and potentially the higher the perceived risk for the provider, especially if equipment costs are factored in.

Impact of Package Choice on Credit Approval

Choosing a lower-tier package, such as the ENTERTAINMENT or CHOICE package, may present a lower barrier to entry for those with credit concerns. These packages typically have lower monthly costs, reducing the overall financial commitment and risk for DIRECTV.

Conversely, opting for the ULTIMATE or PREMIER packages, which include premium channels and often more advanced equipment (like Genie HD DVRs), might be subject to stricter credit requirements. If your credit is borderline, starting with a more affordable package is often a strategic move.

Equipment Costs and Leases

DIRECTV typically provides customers with receivers and a satellite dish. In many cases, this equipment is leased, and the monthly cost is either included in the package price or itemized separately. For customers with poor credit, the provider might require an upfront payment for equipment leases or even mandate the purchase of equipment.

Key points:

Always clarify all equipment-related costs and policies before signing up.

Promotional Offers and Their Credit Implications

DIRECTV frequently offers promotions, such as discounted monthly rates for the first 12-24 months, free premium channels, or waived installation fees. These attractive offers are often contingent upon a good credit score.

For customers with fair or poor credit, these top-tier promotions might be unavailable. You may still qualify for service, but likely at the standard rate without the introductory discounts. This is another reason why starting with a lower-tier package might be more feasible.

Example Pricing Comparison (Illustrative - 2025-26):

Package Est. Monthly Price (Standard) Est. Monthly Price (Promotional - Good Credit) Deposit Likely (Bad Credit) ENTERTAINMENT $80.00 $65.00 $100 - $200 CHOICE $100.00 $85.00 $150 - $250 ULTIMATE $115.00 $100.00 $200 - $300 Note: Prices are estimates for 2025-26 and do not include potential equipment fees, taxes, or regional sports fees. Promotional pricing typically requires a 24-month commitment.

Managing Your Account Responsibly

Once you've secured DIRECTV service, maintaining a good standing is paramount, especially if you've had credit challenges. Responsible account management not only prevents service interruptions but can also lead to the refund of any security deposit and potentially improve your creditworthiness over time.

Ensuring Timely Payments

This is the cornerstone of responsible account management. DIRECTV, like any service provider, expects payments to be made on time each billing cycle.

Best practices:

Consistently paying on time demonstrates to DIRECTV that you are a reliable customer, which is crucial for maintaining your service and potentially having your deposit returned.

Understanding Your Billing Statement

Take the time to review your monthly bill carefully. Ensure that the charges reflect the package you signed up for and that there are no unexpected fees or increases.

What to look for:

If you notice any discrepancies, contact DIRECTV customer service immediately to resolve them. This proactive approach can prevent billing disputes and ensure you're paying the correct amount.

Contacting Customer Service Proactively

If you anticipate difficulty making a payment, don't wait until you're past due. Contact DIRECTV customer service as soon as possible.

Reasons to contact them:

Being proactive and communicative shows responsibility and can help you avoid service disruptions or negative marks on your account.

Upgrading or Downgrading Service

As your financial situation improves, you might consider upgrading your DIRECTV package. Conversely, if costs become a concern, downgrading might be an option.

Considerations:

Discuss any desired changes with DIRECTV customer service to understand the full implications.

The Path to Deposit Refund

For many customers who paid a security deposit, the ultimate goal is to have it refunded. DIRECTV typically has policies in place for this, usually based on consistent, on-time payments over a specified period.

Common Refund Triggers:

Always confirm the specific deposit refund policy with DIRECTV when you first set up your service, and keep track of your payment history to know when you might be eligible.

Comparing DIRECTV to Other Providers

When evaluating your options for satellite TV, particularly with credit concerns, a thorough comparison with other providers is essential. DIRECTV isn't the only game in town, and understanding the landscape can lead you to the best fit for your needs and financial situation.

DIRECTV vs. DISH Network

These are the two primary satellite TV providers in the United States. Their services are often compared directly.

Credit Policies:

Package Offerings & Pricing:

Equipment:

Recommendation: If credit is a major concern, DISH Network might be a more accessible starting point. However, always compare current promotions and specific credit requirements directly with both providers.

Satellite vs. Cable Providers

While DIRECTV is satellite, traditional cable providers (like Spectrum, Xfinity, Cox) offer an alternative delivery method.

Credit Requirements:

Service Availability:

Channel Lineups & Pricing:

Recommendation: Check availability first. If cable is an option, compare its credit policies and pricing against DIRECTV and DISH.

Internet Streaming Services Revisited

As mentioned earlier, these are often the most credit-friendly options.

DIRECTV Stream (formerly AT&T TV):

Other Live TV Streamers (YouTube TV, Hulu + Live TV, Sling TV, FuboTV):

Recommendation: For maximum flexibility and minimal credit hurdles, live TV streaming services are often the best choice. They provide a comparable viewing experience to traditional TV for many users.

Factors Beyond Credit

When comparing providers, don't let credit be the only deciding factor. Consider:

By weighing all these factors, you can make an informed decision that balances your entertainment needs with your financial realities.

Expert Advice for Navigating Credit Challenges

Dealing with credit challenges when trying to access essential services like television can be frustrating. However, with the right approach and understanding, you can successfully navigate these obstacles. Here's expert advice to help you secure the TV service you need.

Prioritize Essential Services

If you're struggling with credit, focus on securing the services you truly need first. This often includes utilities (electricity, water, gas), reliable internet (especially if you work from home or have children in school), and a mobile phone plan.

Satellite TV, while desirable for entertainment, is typically considered a non-essential service. By prioritizing and managing your essential bills consistently, you build a positive payment history that can indirectly help your credit score and make it easier to qualify for discretionary services later.

Build a Positive Payment History

The most effective long-term strategy for overcoming bad credit is to consistently pay all your bills on time. This applies not only to credit cards but also to utilities, rent, and any other recurring expenses.

Many services, including some telecom and utility companies, report payment history to credit bureaus. Positive reporting can gradually improve your credit score. Consider services that offer "rent reporting" or "utility reporting" if available, as these can specifically help build your credit history.

Understand the Difference Between Credit Checks

As mentioned earlier, distinguish between "hard" and "soft" inquiries. Applying for a credit card or loan triggers a hard inquiry, which can slightly lower your score. Services like DIRECTV typically perform a "soft" inquiry for service applications, which does not impact your score. This means you can inquire about their policies without harming your credit standing.

However, if you apply for multiple services in a short period, even soft inquiries from different providers might be aggregated by some scoring models. It's wise to research and apply strategically.

Leverage Prepaid and No-Credit-Check Options

For immediate access to entertainment without credit hurdles, prepaid options and no-credit-check streaming services are your best allies. They bypass the credit assessment process entirely.

Expert Tip: Combine a free Over-the-Air (OTA) antenna for local channels with a budget-friendly live TV streaming service like Sling TV or a combination of on-demand services (Netflix, Disney+) for a comprehensive and affordable entertainment solution that requires no credit check.

Seek Professional Financial Advice

If your credit situation is complex or you're struggling with debt management, consider consulting a non-profit credit counseling agency. These organizations can offer:

Look for agencies accredited by the National Foundation for Credit Counseling (NFCC) or the Financial Counseling Association of America (FCAA).

Be Wary of Scams

When dealing with credit issues, you might be more vulnerable to scams. Be cautious of:

Always research companies and read reviews before engaging their services.

The Long Game of Credit Improvement

Ultimately, improving your credit score is a marathon, not a sprint. It requires consistent effort and responsible financial behavior over time. By focusing on paying bills on time, reducing debt, and monitoring your credit reports, you'll gradually enhance your creditworthiness. This will not only open doors to services like DIRECTV with more favorable terms but also improve your overall financial health and access to credit in all aspects of your life.

In conclusion, while having bad credit can present challenges, it doesn't necessarily mean you can't get DIRECTV. By understanding their credit policies, exploring alternatives like streaming services, and employing strategies to improve your application's strength, you can often find a viable solution. Responsible account management after approval is key to maintaining service and potentially recouping any deposits paid.