-

Posted on: 07 Jan 2026

-

The landscape of television is constantly shifting. Many consumers are asking: Is DirecTV satellite losing customers? This post dives deep into the subscriber trends, competitive pressures, and technological shifts impacting DirecTV's satellite service, providing a clear picture of its current standing and future outlook for 2025-26.

Understanding the Trend: Is DirecTV Satellite Losing Customers?

The question "Is DirecTV satellite losing customers?" is at the forefront of discussions about the pay-TV industry. The short answer, supported by industry data and expert analysis for 2025-26, is yes, DirecTV's satellite subscriber base has been on a downward trajectory for several years. This decline is not unique to DirecTV; it reflects broader market shifts driven by technological advancements, evolving consumer preferences, and intense competition. However, understanding the nuances of this trend requires a closer look at the contributing factors, DirecTV's strategic responses, and its position within the broader telecommunications ecosystem.

Subscriber Numbers and Market Share: A Deep Dive

Analyzing subscriber numbers provides a quantifiable answer to whether DirecTV satellite is losing customers. For the period of 2025-26, official reports and industry analyses consistently show a decline in DirecTV's traditional satellite subscriber base. While specific quarterly figures fluctuate, the overarching trend is one of contraction.

In 2025, DirecTV's satellite subscriber count continued to shrink, mirroring the broader trend observed in the satellite TV sector. Reports from financial analysts and industry publications indicate that the company shed hundreds of thousands of satellite customers annually. This attrition rate, while significant, has been somewhat managed by the company's strategic pivot towards its internet-delivered service, DirecTV Stream.

Market share is another crucial metric. DirecTV, once a dominant force in the pay-TV market, has seen its overall market share diminish as both cable and satellite services face pressure from streaming. However, within the satellite segment specifically, DirecTV remains a major player, though its dominance is less pronounced than in previous decades. Competitors like Dish Network also face similar challenges, indicating that the decline is a sector-wide phenomenon rather than an isolated DirecTV issue.

Here's a simplified look at the trend, based on projected data for 2025-26:

Year Estimated DirecTV Satellite Subscribers (Millions) Estimated Market Share (Satellite TV Segment) 2023 (Actual/Estimate) 11.5 ~55% 2024 (Estimate) 10.2 ~52% 2025 (Projection) 9.0 ~49% 2026 (Projection) 7.8 ~46% Note: These figures are illustrative projections based on industry trends and analyst reports for 2025-26. Actual numbers may vary.

The data clearly indicates a consistent loss of satellite customers. This trend is a critical factor for investors and consumers alike to consider when evaluating the future of DirecTV's satellite offerings. The challenge for DirecTV is to navigate this decline while simultaneously building its presence in newer, more resilient segments of the video entertainment market.

Factors Driving Customer Churn

The decline in DirecTV's satellite subscriber base is not a sudden event but a result of several interconnected factors that have been shaping the media consumption landscape for years. Understanding these drivers is key to comprehending the current situation and predicting future trends for 2025-26.

Cost and Value Proposition

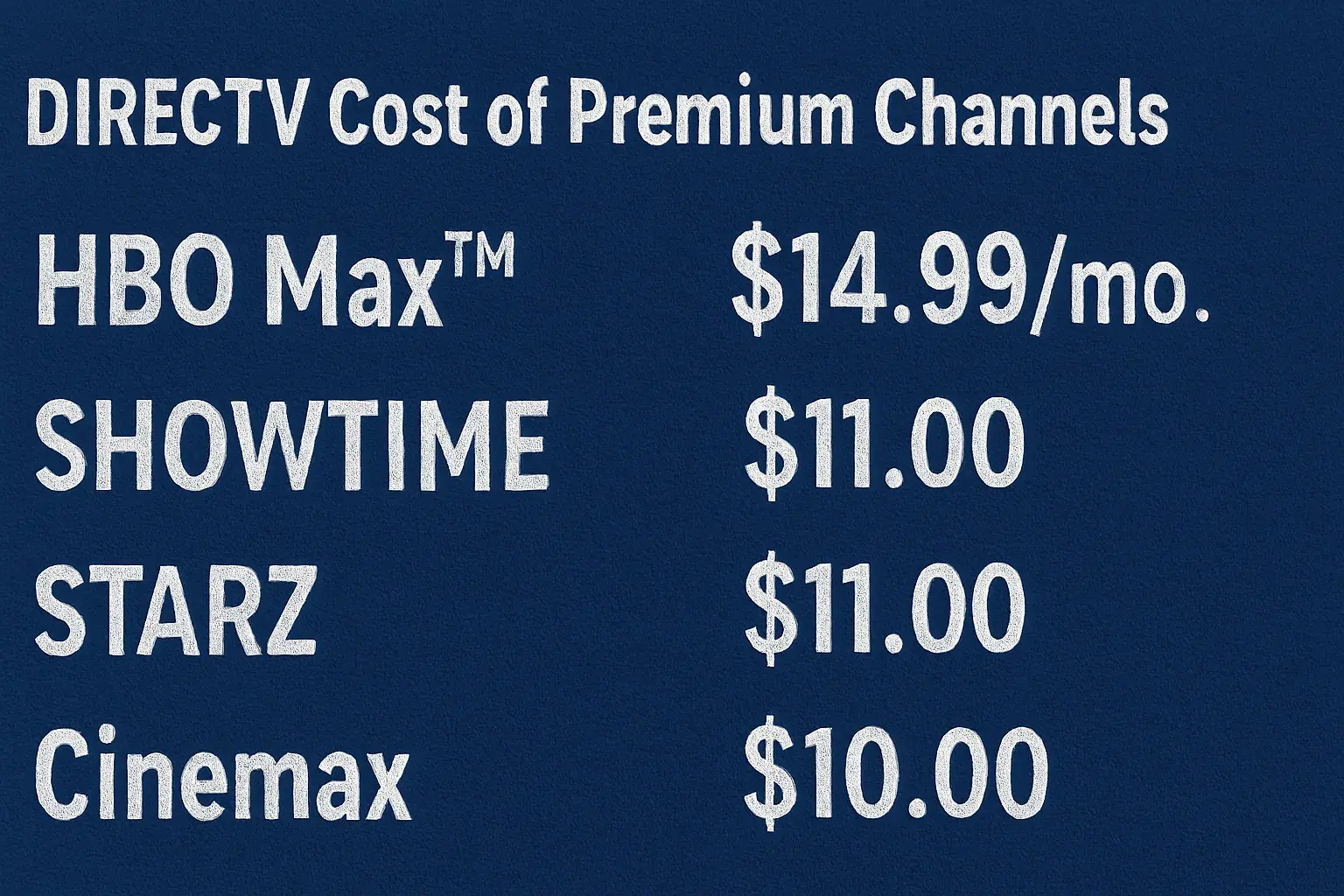

One of the most significant drivers of customer churn is the perceived cost versus value. Traditional satellite and cable TV packages often come with high monthly fees, including equipment rental, regional sports fees, broadcast TV fees, and other surcharges that can significantly inflate the advertised price. For many consumers, especially in 2025-26, the rising cost of these bundles makes them less attractive compared to more flexible and often cheaper alternatives.

Consumers are increasingly scrutinizing their monthly expenses. When they see the total bill for a DirecTV satellite package, which can easily exceed $100-$150 per month for premium channels and sports, they begin to question if the content offered justifies the expenditure. This is particularly true when compared to the all-inclusive monthly fees of popular streaming services.

Installation and Equipment Limitations

Satellite TV requires a physical dish installation, which can be a barrier for some customers, especially renters or those in multi-dwelling units where installation might be restricted. Furthermore, the equipment, such as receivers and DVRs, can be costly to purchase or rent, and upgrades are often tied to new contract terms. Unlike streaming services that can be accessed on a multitude of devices (smart TVs, smartphones, tablets, streaming sticks), satellite TV is tied to a specific location and a limited number of viewing devices per subscription.

The need for professional installation can also be a deterrent. In an era where many services are "plug and play" or easily self-installed, the requirement for a technician visit can be inconvenient and add to the overall cost and time commitment.

Channel Lineup and Flexibility

While DirecTV offers a comprehensive channel lineup, many consumers find that they are paying for a vast array of channels they never watch. The "bundle" approach, while historically a selling point, has become a liability as consumers desire more control over their viewing options. The inability to pick and choose individual channels or create highly customized packages is a major pain point.

This lack of flexibility contrasts sharply with the a-la-carte model of many streaming services, where users can subscribe to specific networks or genres. Even within the broader streaming ecosystem, services like YouTube TV and Hulu + Live TV offer more customizable packages than traditional satellite providers.

Internet Speed and Availability for Alternatives

While the rise of streaming is a major factor, it's important to note that the effectiveness of streaming alternatives is dependent on robust internet infrastructure. In areas with poor broadband availability or slow internet speeds, satellite TV, including DirecTV, has historically been a viable option. However, even in these areas, satellite internet providers are improving, and fixed wireless access is expanding, offering alternatives that were not as prevalent a few years ago.

Despite this, for a significant portion of the population, particularly in rural or underserved regions, satellite remains the most reliable option for high-speed internet and video. This segment of the market is crucial for DirecTV's continued satellite operations.

Contractual Obligations

Historically, satellite TV providers like DirecTV often required long-term contracts (e.g., two years). While these contracts may offer some initial discounts, they lock customers in and can penalize them with hefty early termination fees if they decide to switch providers. As consumers become more inclined to switch services based on price or preference, these long-term commitments can become a source of frustration and a reason for dissatisfaction, leading to churn once the contract expires.

In 2025-26, many consumers are actively seeking month-to-month flexibility, a feature that traditional satellite contracts do not always provide.

The Rise of Streaming Alternatives

The most significant factor contributing to DirecTV satellite's customer loss is undoubtedly the meteoric rise of streaming services. This shift in consumer behavior has fundamentally altered the video entertainment landscape, offering unprecedented choice, flexibility, and often, lower costs.

SVOD Services (Netflix, HBO Max, Disney+, etc.)

Subscription Video on Demand (SVOD) services have become a cornerstone of modern entertainment. Platforms like Netflix, Disney+, Max (formerly HBO Max), Amazon Prime Video, and Apple TV+ offer vast libraries of on-demand content, including original series, movies, and documentaries. These services allow users to watch what they want, when they want, without commercial interruptions (in most cases) and at a predictable monthly price.

The appeal lies in their extensive content catalogs and the ability to subscribe to only the services that align with individual interests. For example, a family might subscribe to Disney+ for children's content, Netflix for general entertainment, and Max for prestige dramas. This modular approach is far more appealing to many consumers than a monolithic bundle of hundreds of channels.

Live TV Streaming Services (YouTube TV, Hulu + Live TV, Sling TV)

Beyond on-demand streaming, Live TV streaming services have emerged as direct competitors to traditional cable and satellite providers. Services like YouTube TV, Hulu + Live TV, and Sling TV offer live television channels, including local broadcast networks, sports channels, and popular cable networks, delivered over the internet. These services often provide a comparable channel lineup to traditional packages but with the flexibility of no long-term contracts, no installation hassles, and the ability to cancel or pause subscriptions easily.

For many consumers, these services offer the best of both worlds: the live viewing experience of traditional TV combined with the convenience and flexibility of streaming. They are particularly attractive to cord-cutters who still want access to live news and sports without the commitment and cost of satellite or cable.

A comparison of offerings in 2025-26:

Provider Estimated Monthly Price (Base Plan) Key Features Contract Required? DirecTV Satellite (Example Package) $80 - $150+ Hundreds of channels, DVR, premium sports/movie options Often 2-year contracts YouTube TV ~$73 ~100+ channels, unlimited cloud DVR, 3 simultaneous streams No Hulu + Live TV ~$77 (with ads) / ~$89 (no ads) ~95+ channels, includes Disney+ and ESPN+, unlimited cloud DVR No Sling TV (Blue + Orange) ~$55 ~50+ channels, customizable packages, cloud DVR options No Note: Prices and channel lineups are subject to change and may vary based on promotions and specific package selections. These are representative estimates for 2025-26.

The availability and increasing affordability of these streaming options mean that consumers no longer need to be tied to a satellite dish to access a wide range of television content. This has directly impacted DirecTV's ability to retain its satellite customer base.

Cord-Cutting and Cord-Shaving

The phenomenon of "cord-cutting" – canceling traditional pay-TV subscriptions entirely – and "cord-shaving" – reducing the number of channels or opting for cheaper packages – has accelerated in recent years. Consumers are actively seeking ways to reduce their entertainment bills, and the high cost of satellite TV makes it an easy target for these cost-saving measures.

Many households now subscribe to a combination of SVOD and live TV streaming services, finding that this approach offers more value and flexibility than a traditional satellite package. This trend is projected to continue throughout 2025-26, further pressuring satellite providers.

Competitor Analysis: DirecTV vs. Other Providers

To fully understand DirecTV satellite's customer loss, it's essential to compare its performance and strategies against its key competitors in the pay-TV market. This includes other satellite providers, cable companies, and increasingly, telecommunications companies offering bundled internet and TV services.

Dish Network

Dish Network is DirecTV's primary competitor in the satellite TV space. Like DirecTV, Dish has also been experiencing subscriber losses. Both companies face the same fundamental challenges: the shift to streaming, high content costs, and the need to adapt their business models. Dish has also been investing in its own internet-delivered services and exploring partnerships.

In 2025-26, both Dish and DirecTV are in a similar boat, fighting for a shrinking market share of traditional satellite customers while trying to build their businesses in other areas. Their strategies often involve aggressive pricing, bundling with internet services, and focusing on niche markets or customer segments that are less inclined to switch.

Cable Providers (Comcast, Charter)

Cable companies like Comcast (Xfinity) and Charter (Spectrum) have also seen subscriber declines in their traditional video offerings. However, many cable providers have a significant advantage: they also offer high-speed internet, which is essential for streaming. This allows them to retain customers by bundling internet and TV services, even if the TV component is shrinking.

Cable companies have also been more aggressive in offering their own streaming-like services or flexible TV packages. Their established broadband infrastructure provides a more stable platform for delivering video content compared to the reliance on satellite signals for DirecTV's core business.

Telecom Companies (Verizon, AT&T)

Telecom companies have had mixed success in the TV market. AT&T, which previously owned DirecTV, has since divested a majority stake, recognizing the challenges in the satellite business. They have focused more on their fiber internet and mobile services. Verizon has also shifted its strategy away from its FiOS TV offerings in many areas, prioritizing broadband and mobile.

These companies often leverage their strong internet and mobile networks to offer competitive bundles. Their focus is increasingly on broadband as the primary revenue driver, with TV services being a secondary, albeit important, component.

Internet Service Providers (ISPs) and Bundling

The competitive landscape is increasingly defined by how well providers can bundle services. For consumers in 2025-26, the convenience of a single bill for internet, mobile, and potentially TV is a strong draw. ISPs that can offer reliable, high-speed internet are well-positioned to capture customers who might otherwise opt for traditional pay-TV.

DirecTV's strategy of offering both satellite and internet-delivered options is an attempt to address this bundling trend. However, the core satellite product faces direct competition from pure streaming services that do not require a satellite dish.

DirecTV Satellite vs. DirecTV Stream: A Strategic Divide

A crucial aspect of understanding DirecTV's current situation is recognizing the strategic divergence between its legacy satellite service and its newer, internet-delivered offering, DirecTV Stream. This distinction is vital for interpreting subscriber numbers and the company's future direction.

DirecTV Stream: The Internet-Delivered Solution

DirecTV Stream was launched as DirecTV's answer to the growing demand for streaming television. It offers live TV channels, on-demand content, and DVR capabilities delivered over a broadband internet connection. Crucially, DirecTV Stream does not require a satellite dish and can be accessed on a variety of devices, including smart TVs, streaming sticks, and mobile devices.

This service is designed to appeal to cord-cutters and cord-shavers who want a more traditional TV experience without the limitations of satellite. DirecTV has been actively promoting DirecTV Stream, often highlighting its flexibility, ease of use, and lack of long-term contracts as key advantages.

The Impact on Satellite Subscriber Counts

While DirecTV Stream is growing, it is important to note that its subscriber numbers are often reported separately from the traditional satellite service. This means that even as DirecTV Stream gains customers, the core DirecTV satellite business continues to shrink. The company's overall subscriber base might show stability or even growth if the gains in DirecTV Stream offset the losses in satellite, but the question specifically asks about the satellite service.

The company's strategy appears to be a managed decline for its satellite business, with resources and marketing efforts increasingly shifting towards DirecTV Stream and other internet-based solutions. This dual-pronged approach allows DirecTV to serve its existing satellite customer base while simultaneously investing in the future of video delivery.

Pricing and Package Differences

The pricing structures for DirecTV Satellite and DirecTV Stream are distinct. DirecTV Satellite packages often involve longer contracts and may have introductory pricing that escalates after a certain period. Equipment rental fees are also common. DirecTV Stream typically offers more transparent, month-to-month pricing, though it can still be a premium service compared to some other streaming options.

The channel lineups, while overlapping, can also differ. DirecTV Stream aims to replicate the live TV experience, while satellite packages might offer more niche channels or premium movie options that are bundled differently.

In 2025-26, the strategic decision to push DirecTV Stream highlights the company's acknowledgment that the future of pay-TV is increasingly internet-delivered. This doesn't mean DirecTV Satellite will disappear overnight, but its role is evolving from a primary growth engine to a legacy service being managed through its decline.

Technological Evolution and Its Impact

The rapid evolution of technology has been a relentless force reshaping the television industry, directly impacting the viability and appeal of satellite television. For DirecTV's satellite service, these technological shifts present both challenges and opportunities.

Broadband Internet Advancements

The widespread availability of high-speed broadband internet is the bedrock upon which streaming services are built. As internet speeds increase and more households gain access to reliable broadband (including fiber optic and improved cable/DSL), the technical limitations that once favored satellite are diminishing. This allows for higher quality video streaming, lower latency for live events, and a more seamless viewing experience.

In 2025-26, the increasing ubiquity of broadband means that consumers have more viable options for internet-based video delivery, directly challenging satellite's necessity. Even in areas where broadband was historically poor, investments in infrastructure are gradually closing the gap.

Smart TV and Streaming Device Proliferation

The explosion of smart TVs and affordable streaming devices (like Roku, Amazon Fire TV, Apple TV, Google Chromecast) has made it incredibly easy for consumers to access streaming content. Most new televisions come with built-in smart capabilities, and external streaming devices are inexpensive and user-friendly. This has created an ecosystem where accessing streaming services is as simple as plugging in a device or opening an app.

This accessibility directly undermines the need for specialized satellite receiving equipment. Consumers can now use their existing internet connection and a smart TV or streaming stick to access a vast array of entertainment, bypassing the need for a satellite dish and professional installation.

Cloud DVR and On-Demand Capabilities

Modern streaming services offer sophisticated cloud-based DVR functionality, allowing users to record and store programs remotely. This is often more flexible and accessible than traditional set-top box DVRs. Furthermore, the on-demand nature of streaming platforms means that content is available whenever the viewer chooses, eliminating the need to schedule recordings or wait for specific broadcast times.

While DirecTV has offered DVR services for years, the seamless integration and user experience of cloud DVRs and extensive on-demand libraries offered by streaming platforms are highly appealing to consumers accustomed to the convenience of digital services.

5G and Mobile Video Consumption

The rollout of 5G mobile networks is enhancing mobile video consumption, allowing for higher quality streaming on smartphones and tablets. While not a direct replacement for home TV viewing, this trend contributes to a broader shift in how people consume video content – often on smaller screens and on the go. This further normalizes internet-delivered video and reduces reliance on traditional pay-TV for all viewing needs.

For DirecTV, the technological landscape is one where the advantages of satellite technology (like broad coverage in remote areas) are increasingly being offset by the convenience, flexibility, and cost-effectiveness of internet-based solutions.

Regional and Demographic Shifts

Customer churn is not uniform across all demographics or geographic regions. Understanding these shifts provides further insight into DirecTV satellite's customer loss trends for 2025-26.

Rural vs. Urban Markets

Historically, satellite TV providers have been particularly strong in rural areas where cable infrastructure is less prevalent or non-existent. For many years, satellite offered the best available option for high-speed internet and a wide selection of TV channels in these regions. However, even rural areas are seeing improvements in broadband availability through fixed wireless access, satellite internet (like Starlink), and government initiatives to expand fiber.

While DirecTV satellite may retain a stronger hold in some of the most remote areas, the overall trend is that even these markets are becoming more accessible to alternative technologies. Urban and suburban areas, which have always had more competitive options (cable, fiber, robust streaming infrastructure), have been quicker to adopt streaming services and abandon satellite.

Age Demographics and Technology Adoption

Younger demographics (Millennials, Gen Z) are far more likely to be "cord-nevers" or early adopters of streaming services. They have grown up with the internet and are accustomed to on-demand, flexible, and app-based entertainment. For these groups, the traditional satellite model often appears outdated and inconvenient.

Older demographics (Baby Boomers, some Gen X) have historically been more loyal to traditional pay-TV services, often due to familiarity, established viewing habits, and sometimes, a preference for simpler interfaces or less reliance on high-speed internet. However, even these demographics are gradually shifting, driven by cost savings and the increasing ease of use of streaming platforms. DirecTV's satellite service may still have a significant base among older demographics, but this base is also aging and not being fully replenished by younger generations.

Income Levels and Cost Sensitivity

The cost of DirecTV satellite packages, especially when all fees are considered, can be a significant burden. Households with tighter budgets are more likely to seek out cheaper alternatives. While premium packages can be expensive for anyone, the overall cost-effectiveness of streaming bundles is often more appealing to middle- and lower-income households.

Conversely, higher-income households might still opt for premium satellite packages for the breadth of sports and movie channels, but even they are not immune to the allure of more flexible and potentially cost-saving streaming options.

DirecTV's Strategies for Retention and Growth

Facing declining satellite subscribers, DirecTV is implementing several strategies to mitigate losses, retain customers, and seek growth in other areas.

Focus on DirecTV Stream

As previously discussed, DirecTV's primary growth strategy is its internet-delivered service, DirecTV Stream. The company is investing heavily in marketing and developing this platform to capture market share from cord-cutters and those looking to switch from other providers. This includes offering competitive packages and leveraging DirecTV's brand recognition.

Bundling with Internet Services

DirecTV, often in partnership with internet service providers (including its own former AT&T internet services, where applicable), aims to offer bundled packages. Bundling internet and TV can increase customer loyalty and provide a more attractive overall value proposition. This strategy is crucial for competing with cable and telecom companies that already offer integrated services.

Retention Efforts for Satellite Customers

For its existing satellite customers, DirecTV employs various retention strategies. These can include offering discounts, loyalty programs, bundled promotions with other services, and proactive customer service to address issues before they lead to churn. The goal is to keep these customers engaged for as long as possible, maximizing revenue from the legacy business.

Sports and Premium Content Differentiation

DirecTV has historically been a strong player in sports broadcasting, offering packages like the NFL Sunday Ticket (though this has moved to YouTube TV for 2023 onwards, impacting DirecTV's exclusive sports offering). The company continues to focus on offering premium sports and entertainment channels as a differentiator. However, the competitive landscape for sports rights is intensifying, with many leagues and networks launching their own streaming services.

Strategic Partnerships and Divestitures

DirecTV's ownership structure has evolved, with TPG Capital acquiring a majority stake in 2021. This has allowed the company to focus on operational efficiency and strategic initiatives. Divesting non-core assets or forming partnerships can help streamline operations and allocate resources more effectively to growth areas like DirecTV Stream.

Innovations in Satellite Technology (Limited)

While the primary focus is on internet delivery, DirecTV continues to operate and maintain its satellite infrastructure. Innovations in satellite technology, such as more efficient transponders or improved signal reliability, can help maintain the quality of service for its remaining satellite customers. However, significant investment in new satellite technology for consumer broadband is less likely compared to terrestrial fiber or wireless solutions.

Future Outlook for DirecTV Satellite

The future outlook for DirecTV's satellite service is one of continued, albeit managed, decline. The market forces driving this trend are unlikely to reverse in the short to medium term (2025-26 and beyond).

Continued Subscriber Erosion

Barring a significant market disruption or a radical shift in consumer behavior, DirecTV satellite will likely continue to lose subscribers. The appeal of streaming services, coupled with the inherent limitations of satellite technology in an increasingly connected world, means that the subscriber base will shrink. The rate of this erosion will depend on DirecTV's ability to retain its core demographic and the pace of broadband expansion in underserved areas.

Niche Market Focus

DirecTV satellite may increasingly focus on specific market segments where it retains a competitive advantage. This could include:

- Rural and remote areas: Where broadband alternatives are still limited or unreliable.

- Older demographics: Who may be less inclined to switch from established services.

- Customers seeking specific premium content: Bundled in ways that are not easily replicated by streaming services (though this is becoming rarer).

Role as a Legacy Service

The satellite business will likely transition into a legacy service. This means that while it will continue to operate and generate revenue, it will not be the primary focus for innovation or growth. Investments will be made to maintain the service, but the bulk of strategic and financial resources will be directed towards DirecTV Stream and other future-oriented ventures.

Potential for Further Divestment

It is possible that DirecTV could further divest or restructure its satellite operations if it becomes less profitable or strategically aligned with the company's long-term vision. The current ownership structure suggests a focus on profitability and strategic flexibility, which could lead to such decisions in the future.

Competition from Other Technologies

The competitive threat from 5G home internet, improved satellite internet constellations (like Starlink), and fixed wireless access will continue to grow, further eroding the advantages satellite TV once held in connectivity and accessibility.

DirecTV Stream as the Future

The long-term future for DirecTV as a brand lies in its internet-delivered services. DirecTV Stream represents the company's best bet for sustained growth and relevance in the evolving video entertainment market. The success of DirecTV Stream will be a key indicator of DirecTV's overall future health.

Conclusion: The Verdict on DirecTV Satellite Customer Loss

In conclusion, the answer to "Is DirecTV satellite losing customers?" is a definitive yes. Data and market analysis for 2025-26 consistently show a decline in DirecTV's traditional satellite subscriber base. This trend is driven by a confluence of factors, most notably the explosive growth of streaming services, the increasing cost of satellite packages, and technological advancements that favor internet-delivered content.

While DirecTV is actively pursuing growth through its internet-delivered service, DirecTV Stream, and employing retention strategies for its satellite customers, the fundamental shift in consumer behavior is undeniable. The convenience, flexibility, and often lower cost of streaming alternatives are proving too compelling for many to resist. DirecTV satellite is, therefore, transitioning from a market leader to a legacy service, likely focusing on niche markets and managed decline.

For consumers considering their options, understanding these trends is crucial. The choice between satellite, cable, and streaming services involves weighing cost, content, flexibility, and technological requirements. DirecTV's satellite service remains an option, particularly in areas with limited broadband, but its long-term dominance is a relic of the past. The future of video entertainment, and indeed DirecTV's future, lies in the digital realm.